“What is now proved was once only imagined,” wrote William Blake.

Today, this paradigm is no longer confined to the artistic or poetic. It is the mantra of technological innovation in finance.

The leap from traditional banking to digital platforms was significant, but the advent of immersive AI like GPT-4o and the Metaverse promises a revolution.

These advancements are ushering in a phase where customer engagement becomes deeply personalized, services are tailored with unprecedented precision, and operational efficiencies reach new heights. Like accessing your bank account in a virtual environment where an AI advisor provides intuitive, real-time assistance. Or a back-end operation so streamlined by predictive analytics that inefficiencies become a thing of the past.

In this article, let us uncover the transformative power of these technologies, illustrating how they will reshape both the internal workings and external interfaces of financial institutions (FIs).

The Relevance of Immersive Banking

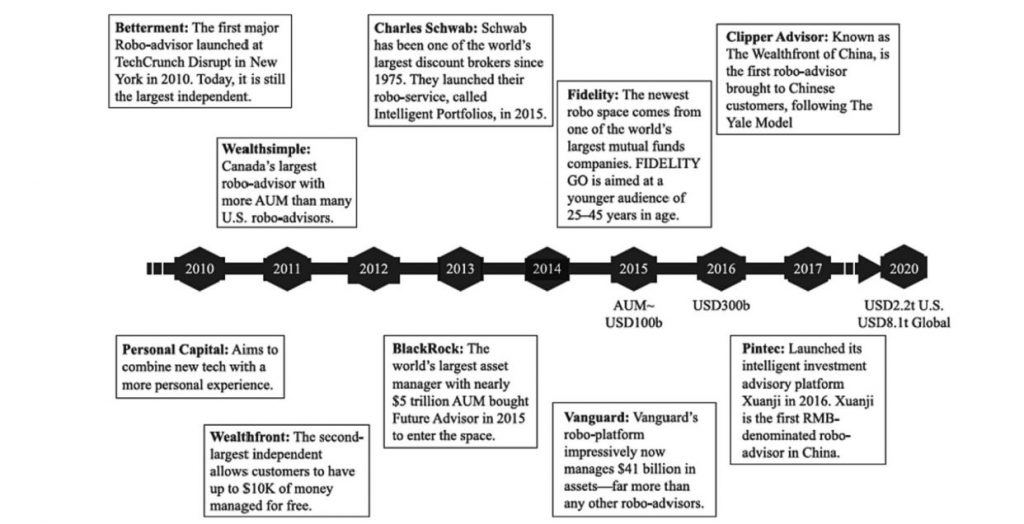

Historically, significant technological shifts have often been driven by visionary thinking rather than immediate gains. Consider the early days of the internet: while its initial adoption was fueled by email and simple web pages, its true potential lay in the vast, interconnected world it would eventually create. Similarly, the metaverse offers far more than just a novel customer experience or a new way to transact. It has the potential to become a foundational platform for the next generation of financial services.

Metaverse for Financial Institutions

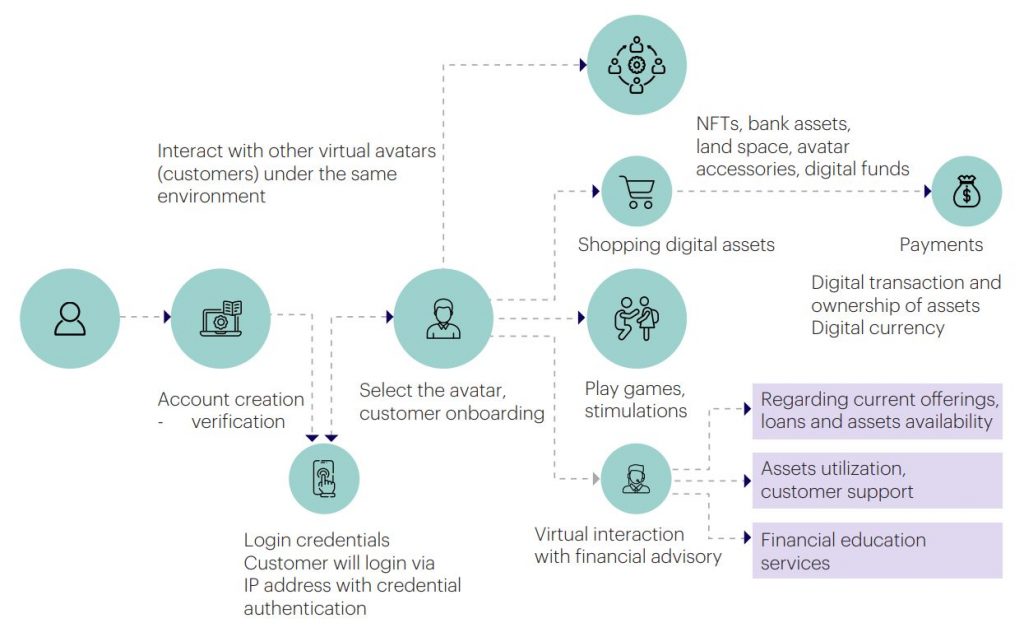

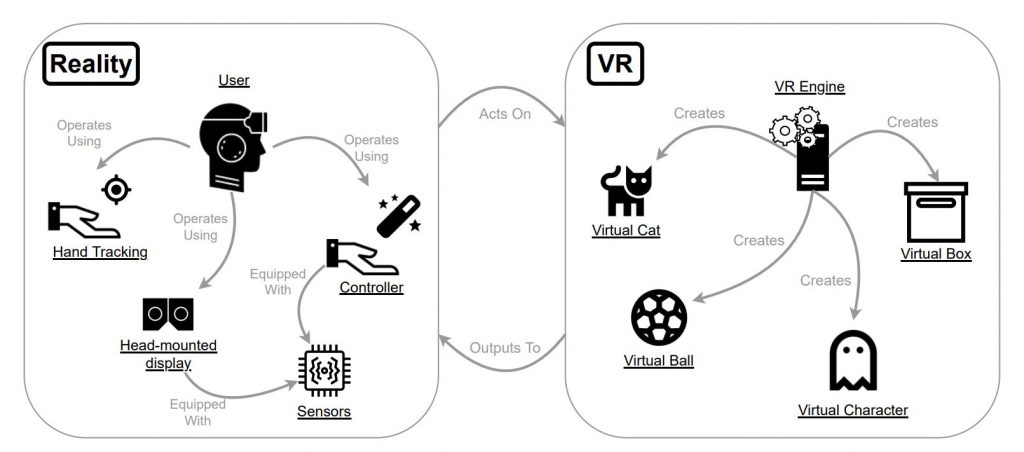

Imagine a world where customer engagement is not limited to physical branches or static websites. Instead, FIs could create immersive, interactive environments where clients can explore financial products, receive personalized advice from AI-driven avatars, and even attend virtual financial planning workshops, all from the comfort of their homes.

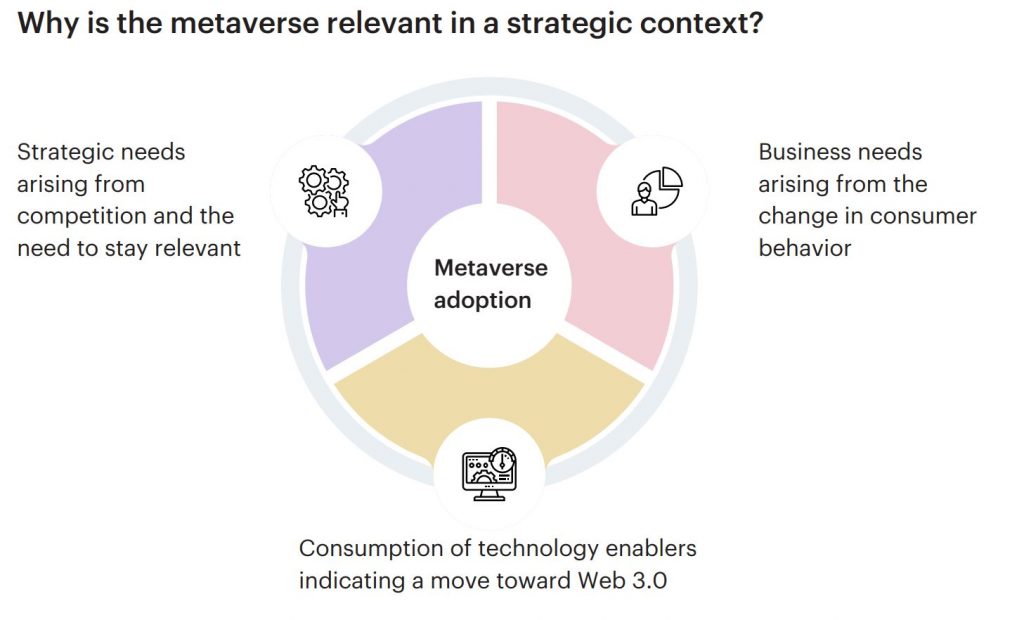

To capitalize on this potential, FIs need to shift their focus from micro-goals—such as immediate ROI on specific technologies—to macro goals that encompass long-term growth, innovation, and customer loyalty.

Banks will need to use a framework like the above, which offers a vision of customizable solutions for financial institutions in this new future. This flexibility ensures adaptability to evolving technologies and customer expectations. Implementing these solutions through low-cost, low-risk pilots will enable institutions to test and refine their offerings, ensuring a robust and user-friendly final product.

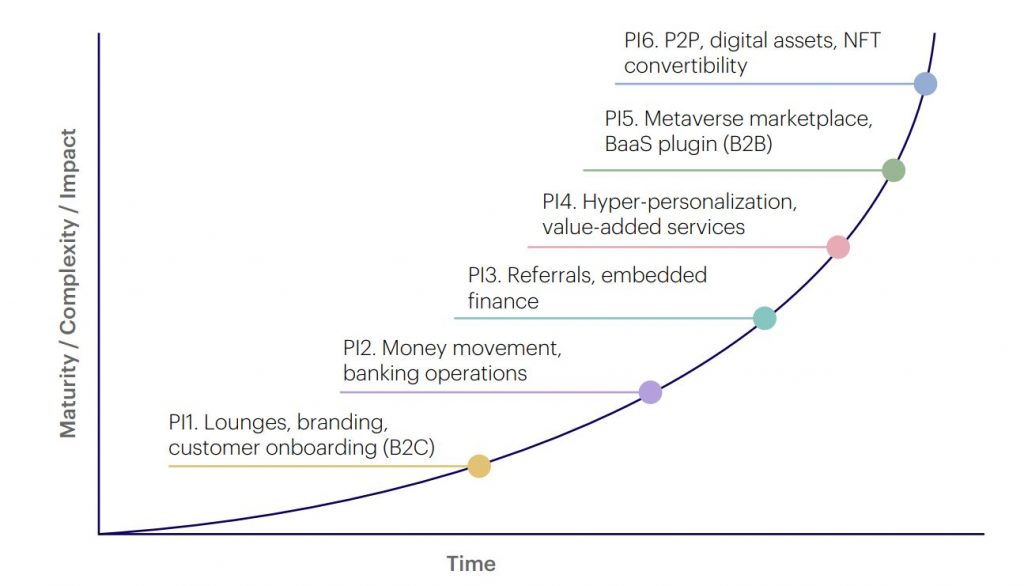

Let us explore how the immersive bank of the future might transition through these phases.

- Lounges and Branding

Virtual lounges, accessed through VR or mobile devices, will serve as the first point of contact, blending familiarity with futuristic charm. These spaces, adorned with the bank’s branding, will allow customers to explore services and interact with AI-driven advisors. Onboarding processes will become interactive and engaging, transforming the initial customer experience.

- Money Movement and Banking Operations

Soon after, basic banking operations will be seamlessly integrated into immersive environments. In the future, customers will check account balances, transfer funds, and manage their finances through holographic interfaces or voice commands using their smartphones or VR devices.

This shift will enhance user interaction, making everyday banking efficient and enjoyable.

- Referrals and Embedded Finance

Leveraging referrals will take on new dimensions within immersive worlds. Customers will receive recommendations for financial products while exploring virtual environments seamlessly integrated with the bank’s system. Embedded finance AI will allow these transactions to happen in real-time, expanding the bank’s reach within digital spaces.

Immersive and Hyper-Personalized Customer Engagement

- Hyper-Personalization and Value-Added Services

Hyper-personalization will redefine financial services. AI will analyze user data to offer tailored financial advice and products. Virtual advisors, accessible through phones or VR headsets, will provide personalized investment tips and savings plans based on individual financial histories and goals.

- Metaverse Marketplace and BaaS Plugins

The concept of a metaverse marketplace will revolutionize how financial products and services are explored. Customers will use their mobile devices or VR setups to compare offerings, interact with financial advisors, and make informed decisions. Banks will extend their reach by offering Banking as a Service (BaaS) plugins to third-party providers, enhancing the ecosystem with integrated financial solutions.

- P2P and Blockchain Integration

Facilitating peer-to-peer (P2P) transactions and leveraging blockchain technology will become commonplace. The metaverse and virtual banking environments will become a secure platform for direct interactions. Users will conduct transactions, manage digital assets, and enjoy the transparency and security provided by blockchain. This will enhance financial capabilities and tap into the growing interest in decentralized finance (DeFi).

Immersive Personal Finance: AI, ML, Voice, and the Screenless Future

Key Concepts of Immersive AI/Internet of Senses

The Rise of Screenless Interfaces

Soon, managing your finances will no longer involve staring at a screen filled with endless charts and numbers. Instead, you will engage with AI through voice commands, making financial management as intuitive as having a conversation. This vision is rapidly becoming a reality as voice capture and machine learning technologies evolve, replacing traditional interfaces with more natural, human-centric interactions.

One notable example of this shift is the Rabbit R1, an AI-driven pocket companion that signals a future beyond mobile phones. Unlike traditional apps that require navigating through menus and typing commands, devices like the Rabbit R1 and the Humane AI pin use voice prompts to deliver answers and perform tasks. This approach simplifies interactions, making financial management more accessible and less daunting for the average user.

In this screenless future, personal finance will focus on understanding and convenience rather than data overload. The transition to voice interfaces with multimodal models signifies a move towards a more user-friendly financial ecosystem, where complex financial operations can be executed through simple, conversational exchanges.

Simplified Financial Management

In the coming years, AI will revolutionize how we manage our finances by providing direct, personalized answers to financial questions. You will ask your AI financial assistant, “How much can I save this month if I reduce my dining out expenses?” and receive an immediate, accurate response. This level of interaction will make budgeting, saving, and investment allocation seamless and efficient.

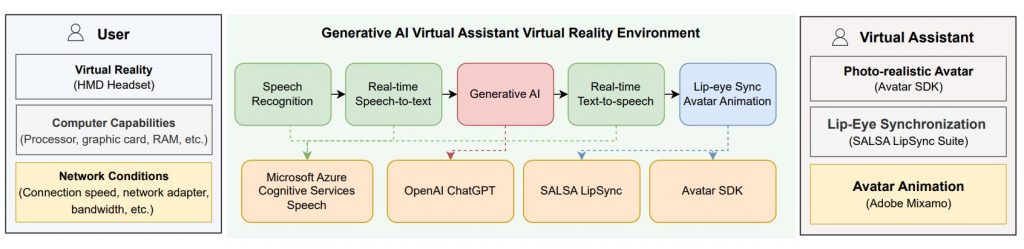

System architecture of sample VR environment with GenAI-based embodied virtual assistant

AI-driven platforms will analyze your spending patterns, income, and financial goals to offer tailored advice. For example, you could inquire about the best 401k plan for your situation, and the AI would consider your current financial status, future projections, and market trends to provide a recommendation. This goes beyond generic advice, delivering insights that are uniquely relevant to you.

The screenless interface, coupled with AI and machine learning, will also streamline complex financial tasks. Setting up a savings plan, applying for loans, or even managing investments will all be handled through simple voice commands.

AI-Driven Financial Ecosystems

Gone will be the days of juggling multiple apps for banking, investments, insurance, and budgeting. Instead, a fully immersive financial experience will emerge, where all these services coexist harmoniously within one platform. The benefits of such an integrated system are manifold: reduced complexity, increased convenience, and enhanced user engagement.

The backbone of this AI-driven financial ecosystem will be robust data integration and analysis. By aggregating data from multiple sources—bank accounts, credit cards, investment portfolios, and even social media activity—AI can comprehensively understand an individual’s financial landscape. If there is a significant market shift or a change in your income, the AI can immediately adjust your financial plan, providing you with up-to-date guidance.

AI-powered virtual financial advisors will redefine customer service by providing 24/7 access to financial advice. For instance, you might receive a notification “Your spending on dining out has increased by 20% this month. Would you like to adjust your budget or receive tips on saving?”

Virtual bank and FI branches will revolutionize the way customers interact with their financial institutions. These branches will offer the primary banking services traditionally provided by physical locations but in a more convenient and engaging virtual environment. Customers will access these branches through VR headsets or mobile devices, stepping into a digital space where they can perform transactions, meet with advisors, and explore financial products. These branches will minimize the need for physical office space, significantly reducing operational costs.

Wealth Management in the Metaverse

Interactive advisory services are set to transform wealth management. Financial planning will become an immersive experience, with clients able to visualize and interact with their financial goals. This approach goes beyond traditional methods by allowing clients to plan significant life events, such as vacations or home purchases, in a virtual realm.

Financial simulations will take on a new dimension through immersive AI. Interactive virtual environments will offer gamified experiences designed to enhance financial literacy. For instance, retirement fund simulations can illustrate how different investment choices might impact future savings. To see real-time outcomes, clients will use Monte Carlo simulations to experiment with scenarios such as economic downturns or geopolitical events.

Emerging virtual markets, such as virtual real estate and cryptocurrencies, present new investment opportunities for wealth management clients. The metaverse will provide a platform for exploring these assets, allowing clients to diversify their portfolios with innovative investment options.

Sustainable investing will be visually enhanced. Wealth managers can leverage immersive platforms to promote environment-friendly funds, using visual cues like vibrant greenery to indicate sustainable options. Non-sustainable investments might be marked with red flags, making it easier for clients to identify and choose investments that align with their values.

Revolutionizing Financial Processes

Contrary to the assumption that virtual environments might depersonalize interactions, the immersive nature of AI-driven training and collaborative workspaces will actually enhance the human element in professional development and teamwork.

Immersive Training and Development

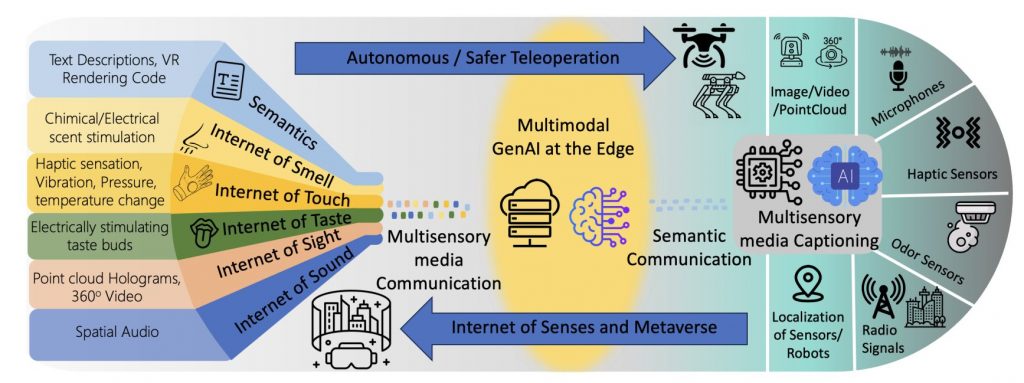

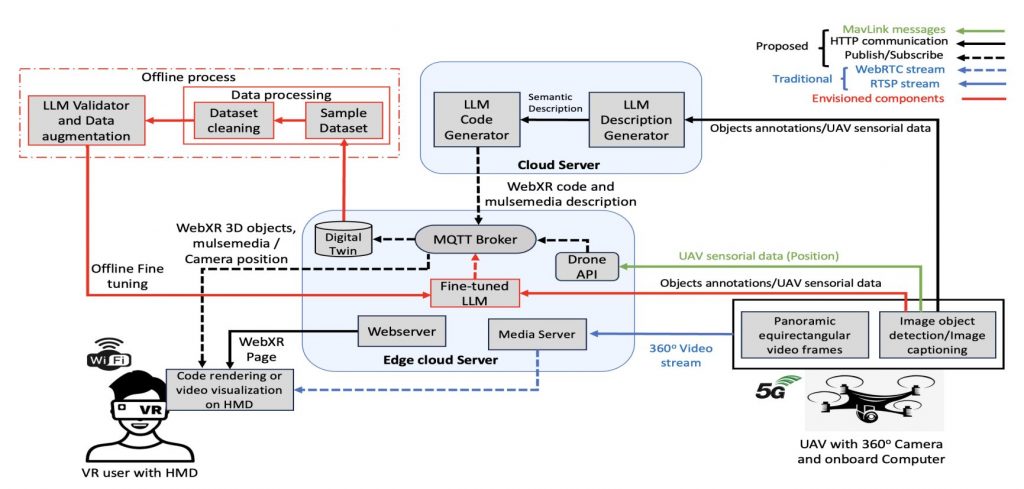

Proposed architecture for GenAI-enabled immersive communication

Traditional training methods, often limited by physical constraints and static content, will be transformed into dynamic, immersive experiences with AR, VR, and AI. Financial professionals will engage in lifelike simulations that replicate market scenarios, compliance challenges, and customer interactions, providing a risk-free environment to hone their skills.

For example, a financial advisor could navigate a simulated market crash, learning to manage client portfolios under stress, while compliance officers could engage in interactive scenarios that highlight the intricacies of regulatory requirements.

Collaborative AI Workspaces

The future of work in the financial industry will be characterized by collaborative AI workspaces that enable teams to operate in a seamlessly integrated virtual environment. These workspaces will leverage multi-modal AI, combining text, voice, and visual data to facilitate real-time collaboration and decision-making. Financial institutions will utilize these platforms to break down silos and foster a culture of continuous innovation.

Left: Regular home office working environment with only one display. Center: Augmented workspace with virtual displays extending the available screen space. Right: Portable nomadic office with entirely virtual display space presented through the headset. Only the peripherals remain physical for familiar interaction. (Reference)

- AI-Driven Project Management: Within these virtual workspaces, AI-driven tools will play a pivotal role in project management and team coordination. Advanced algorithms will analyze project timelines, resource allocations, and team performance, providing actionable insights to optimize workflows.

- Data-driven decision-making: Financial analysts and strategists will access a unified platform where they can visualize complex datasets, run simulations, and forecast outcomes. This integration of AI tools will enable more accurate and timely decisions, driving better business results.

- Enhanced Empathy and Skills: The ability to simulate high-stakes scenarios and receive real-time feedback will create more empathetic and skilled professionals who are adept at handling complex client needs and regulatory landscapes.

- Proactive Management: The shift to virtual workspaces will not merely replicate traditional office settings in a digital format but will fundamentally change how financial institutions operate. The predictive capabilities of AI will lead to proactive rather than reactive management, with systems anticipating challenges and opportunities before they arise.

These AI-enhanced environments will also support remote work, allowing teams to collaborate effectively regardless of geographical barriers, thus attracting a global talent pool and fostering diversity and inclusion within the organization.

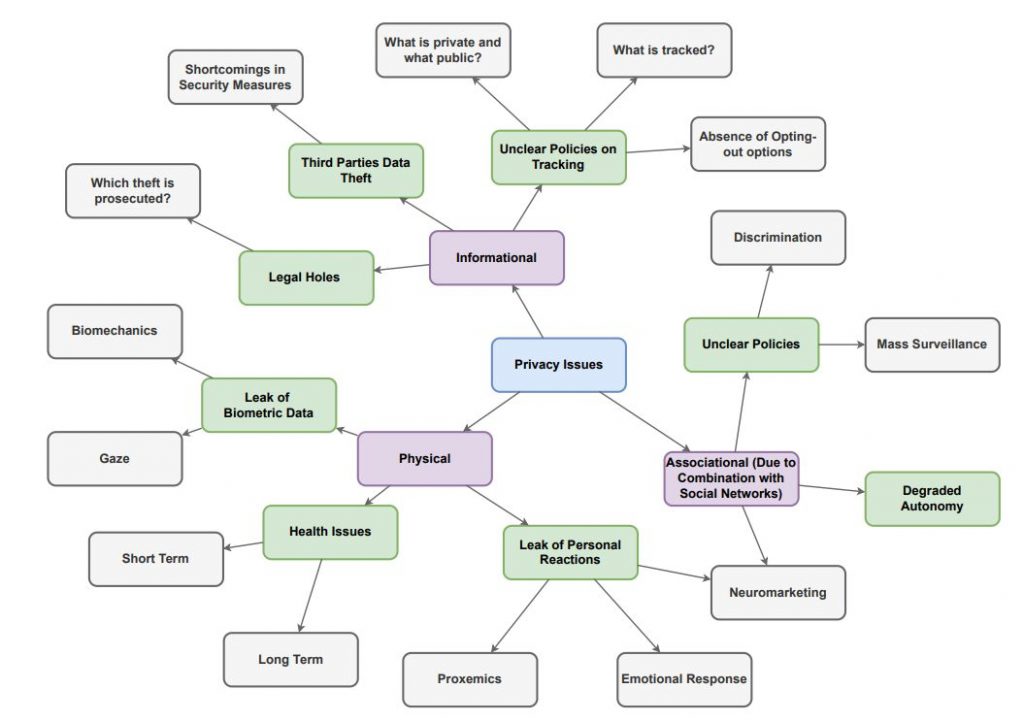

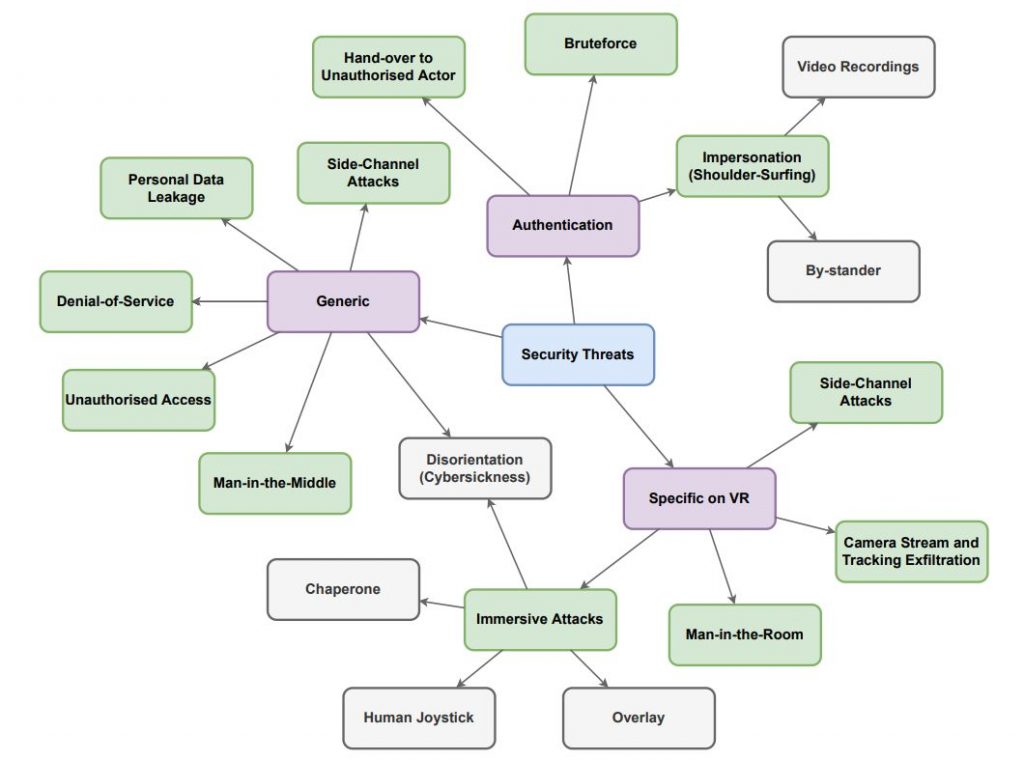

Security and Compliance in an Immersive World

Navigating the labyrinth of data protection regulations, such as GDPR and CCPA, while leveraging multi-modal AI, requires a delicate balance. The complexity of immersive AI environments increases the potential attack surfaces for cyber threats. Virtual reality (VR) environments and AI-driven platforms could be targeted by sophisticated phishing attacks or deepfake technology, where malicious actors create realistic but fraudulent interactions to deceive users.

Institutions must ensure that immersive experiences do not compromise compliance. This involves implementing stringent access controls, regular audits, and transparent data handling practices. Multi-factor authentication (MFA) and biometric verification will become standard practices to secure access to virtual environments.

While the rise of immersive AI might seem like a hacker’s paradise, it will, paradoxically, lead to a more secure financial environment. The continuous monitoring and adaptive learning capabilities of AI systems mean that security protocols will evolve faster than ever, outpacing traditional and new threats. FIs may be able to use AI systems that not only alert them to new regulations but also suggest the best ways to integrate these changes into existing compliance frameworks.

Conclusion

In this immersive, brave new world, financial institutions will navigate uncharted waters, guided by the twin stars of innovation and security. The potential rewards are immense – personalized customer experiences that feel almost magical, seamless and proactive compliance mechanisms, and a workforce trained in the crucible of hyper-realistic simulations.

We must embrace the paradox of our times: technology that makes our interactions less tangible yet more meaningful, AI that makes decisions devoid of human touch yet imbued with unprecedented empathy and precision.

With GPT-4o and the rest of its multimodal ilk, the future of finance is an ecosystem that is not impersonal but becomes a trusted partner in people’s life journeys.