The year is 2024, and the world of asset management is in flux.

A decade ago, few could have predicted the seismic shifts that would reshape the industry – from the rise of passive investing and the democratization of financial data to the existential threat of climate change and the disruptive power of artificial intelligence. Yet here we are, on the cusp of a new era, where the old rules no longer apply, and the winners will be those who can adapt to a rapidly changing landscape.

In this article, we’ll peer into the crystal ball to uncover the key trends and innovations that will define the future of asset management.

Key Challenges Facing Asset Managers in 2024

As asset managers steer through the uncharted waters of a post-pandemic world, they will be forced to confront a host of obstacles that threaten to upend the status quo.

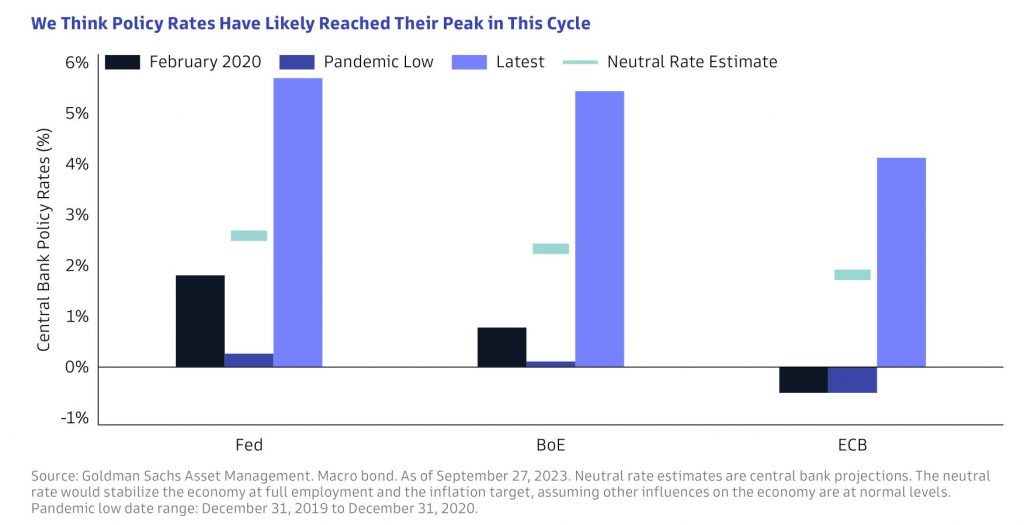

Economic Uncertainty and Market Volatility

First and foremost among these challenges is the specter of economic uncertainty and market volatility. With interest rates on the rise and the ghosts of inflation haunting the global economy, asset managers will need to be nimble and adaptable to stay ahead of the curve. According to EY’s research, the industry could face a staggering 17-19% decline in operating margins in a pessimistic scenario.

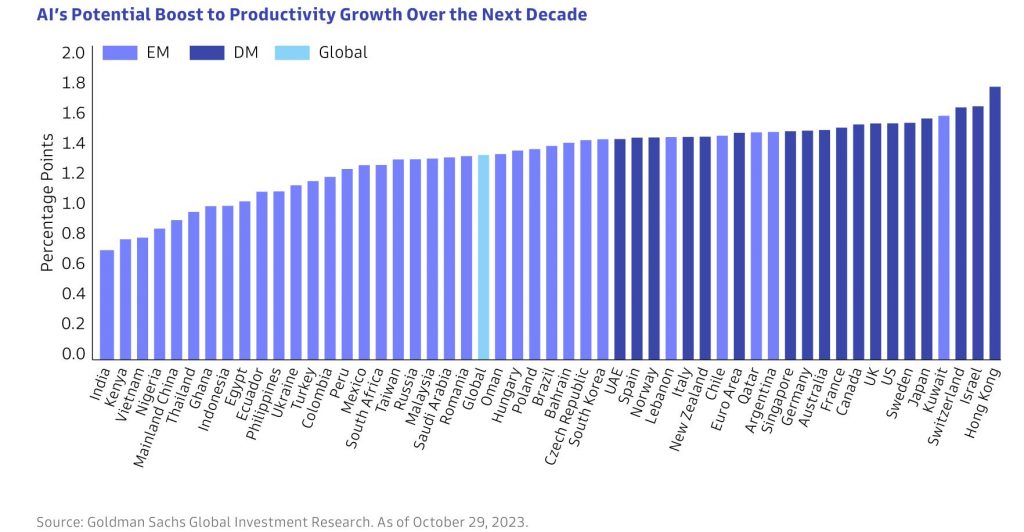

Technological Disruption

But the challenges don’t stop there. The rapid pace of technological change is forcing asset managers to confront the need for digital transformation head-on. As investors increasingly demand seamless, digitized experiences and robo-advisors nip at the heels of traditional firms, asset managers must invest in cutting-edge technologies like artificial intelligence and blockchain to stay relevant.

EY estimates that by 2027, 54% of consumers will make some use of environmental, social and governance (ESG) data for decision-making.

Changing Demographics and Evolving Investor Preferences

At the same time, asset managers must grapple with the changing demographics and evolving preferences of their investor base. As millennials and Gen Z increasingly enter the market, they bring with them a new set of values and expectations, prioritizing socially responsible investing and demanding greater transparency and accountability from the firms they entrust with their money.

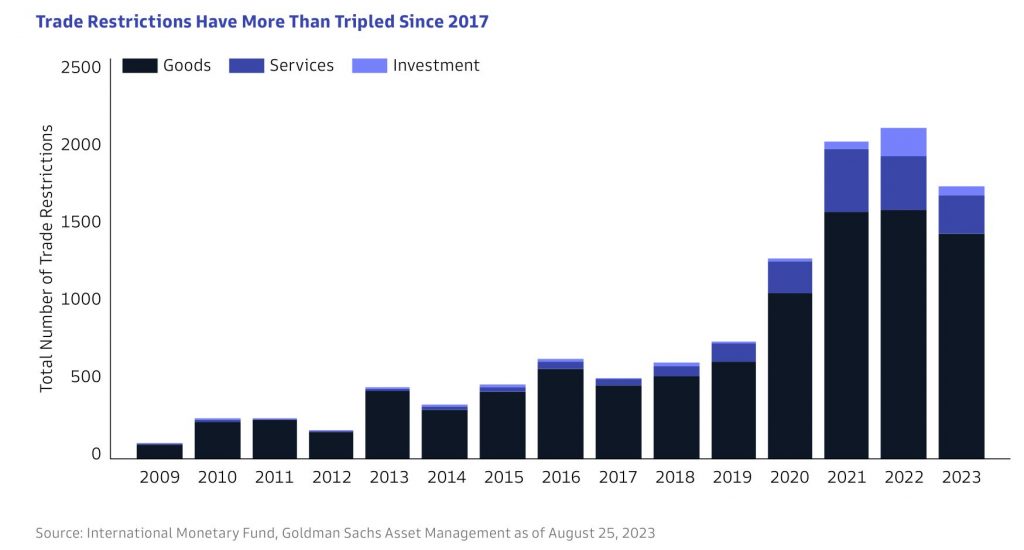

Geopolitical Shifts and Regulatory Complexities

From the ripple effects of the Russia-Ukraine conflict to the looming specter of a US-China trade war, asset managers must navigate a minefield of political risks and regulatory pitfalls. The increasing focus on issues like data privacy and investor protection will require firms to stay on their toes and adapt to a constantly shifting compliance landscape.

Pressure on Profitability

Finally, asset managers will feel the squeeze of pressure on profitability, as slower AuM growth, fee compression, and rising costs eat into their bottom lines. EY’s model predicts a sobering 5 -7% decline in aggregate operating margins up to 2027 in their base scenario.

Trends Shaping Asset Management in 2024

As investors seek out new sources of returns in an uncertain world, a series of key trends is likely to define the asset management world.

Continued Growth of Private Credit

As regulatory changes like Basel III reshape the lending landscape, banks will increasingly pass the torch to private credit funds, fueling their expansion beyond leveraged finance into the broader territories of corporate lending and asset-backed finance.

But with great power comes great responsibility, and asset managers will need to build the operational muscle to shoulder this new burden. Partnerships with banks will be the key to unlocking deal flow, as private credit funds step into the void left by traditional lenders.

Opportunities in Cash Management and Fixed Income

As yields plateau and investors seek safe havens, asset managers will find themselves in a mad dash to capture the trillions in cash on the sidelines. But to lure these skittish investors off the bench, they’ll need to get creative, developing new products that offer the holy grail of stability and returns.

Meanwhile, the revival of active fixed-income management will offer a tempting alternative for those seeking to escape the low-yield doldrums. Structured products, once the black sheep of the investment world, will come back into fashion as investors seek out new sources of alpha in a yield-starved landscape.

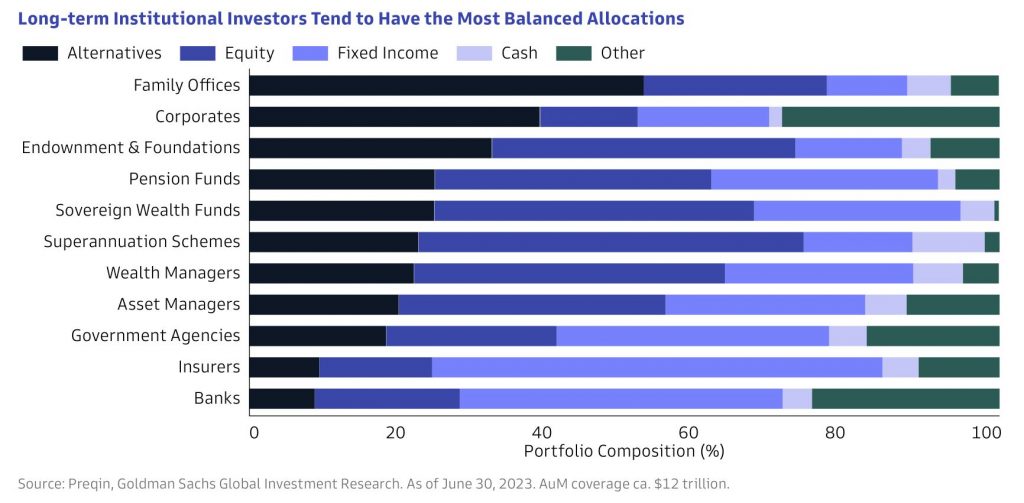

Alternative Investments Pursuit

For alternative investment managers, the siren song of the insurance industry will prove irresistible. But capturing this elusive prize will require a multi-pronged approach, from buying up insurance platforms outright to managing sidecar assets and overhauling operating models to cater to the unique needs of insurers. The EY model predicts that alternatives’ share of total revenues in the industry will rise from 44% – 48% between 2022-2027.

Those who can crack the code will find themselves swimming in a vast ocean of opportunity, with new liabilities, geographies, and higher-yielding assets ripe for the taking. But as competition heats up, the early movers who have already staked their claims will be the ones to watch.

Strategic Cost Management

In the face of relentless fee compression and rising costs, asset managers will need to sharpen their pencils. But rather than simply slashing and burning, the savviest firms will adopt a surgical approach, focusing on the “good” costs that create differentiated client value while ruthlessly eliminating the “bad.”

This will require a new level of transparency and granularity, as asset managers dig deep into their cost structures to uncover the true drivers of profitability.

Japan’s Rising Market Potential

As the Land of the Rising Sun sets its sights on becoming a global financial hub, asset managers will find themselves drawn to the untapped potential of the Japanese market. With the government introducing sweeping reforms to spur competition and innovation, the stage is set for a new era of growth and opportunity.

For alternative managers, the Japanese market offers a tantalizing mix of untapped origination opportunities and a growing demand for innovative insurance solutions. As Japanese insurers grapple with an aging population and low yields, asset managers who can help them navigate these challenges will find themselves well-positioned to capture a slice of this $5 trillion market.

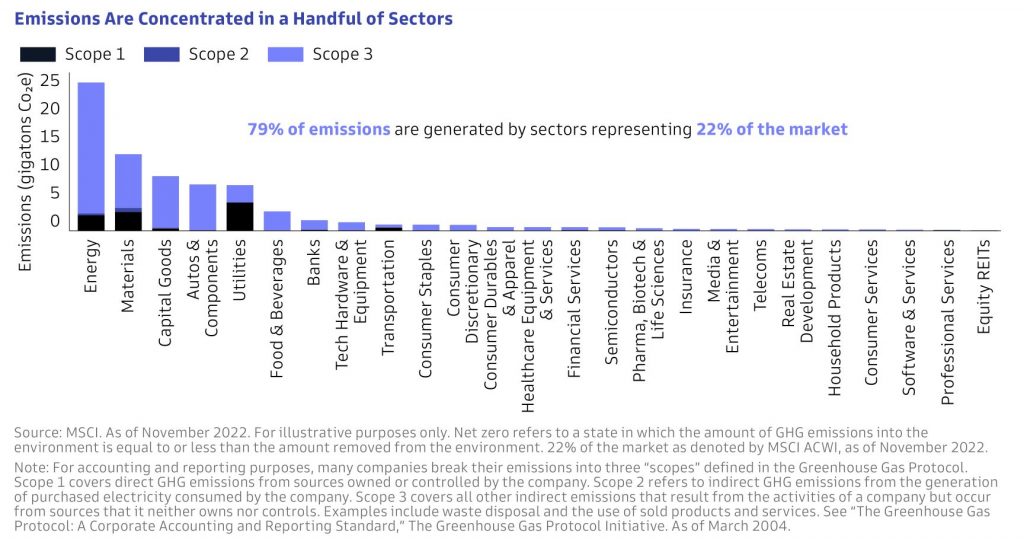

Bifurcation of ESG Strategies

As the ESG revolution gathers steam, asset managers will find themselves at a crossroads. Some will opt for the well-trodden path of integration, weaving ESG factors into the fabric of their existing mandates and offering clients a bespoke approach tailored to their unique values and beliefs. Others will blaze a new trail, focusing on the real-world impact of their investments through thematic and impact funds that aim to move the needle on the most pressing challenges of our time.

But even as these two camps diverge, they will be united by a common goal: to deliver both financial returns and positive social and environmental outcomes.

Enhanced Product R&D

In a world where innovation is the key to survival, asset managers will need to up their game when it comes to product research and development. Gone are the days when a siloed approach to R&D could suffice. Instead, firms will need to build stand-alone R&D functions that bridge the gap between portfolio management and distribution.

Asset managers will need to harness the power of data and artificial intelligence to uncover new insights and opportunities. As the boundaries between traditional and alternative assets blur, firms will need to develop offerings that take advantage of newer technologies like tokenization and direct indexing.

Personalized Models for High-Net-Worth Clients

For high-net-worth clients, the expectations have never been higher. No longer content with off-the-shelf solutions, these discerning investors demand a level of personalization and sophistication that can only be achieved through cutting-edge technology and a deep understanding of their unique needs and goals.

To meet this challenge, asset managers will need to invest in advanced optimization engines and alternative investment technologies that can deliver customized solutions at scale.

Increased Liquidity in Private Markets

As investors flock to private markets in search of higher yields and diversification, asset managers will need to find new ways to provide liquidity in these traditionally illiquid assets. Innovative structures like semi-liquid funds and advancements in fund administration technology will be key to unlocking this puzzle.

Meanwhile, the growing interest in limited partner secondaries and net asset value-based lending will create new opportunities for asset managers to provide liquidity to investors looking to exit their positions or access capital without selling their stakes. As the demand for transparency and efficiency in private markets grows, new marketplaces and trading platforms will emerge.

Bolder M&A and Post-Deal Integration Strategies

Rather than pursuing deals for the sake of growth alone, firms will need to focus on filling specific capability gaps, particularly in private markets.

As private equity firms increasingly set their sights on the asset management industry, we can expect to see a wave of consolidation led by these deep-pocketed investors. But the success of these deals will hinge on the ability of asset managers to execute on the post-deal integration, bringing together disparate operating platforms and distribution engines.

Firms will need to abandon the “hands-off” approach of the past and instead pursue a more intentional strategy of integration – one that leverages the strengths of each organization while minimizing disruption to clients and employees.

The Growing Role of Hedge Funds

Global macro strategies, which seek to profit from macroeconomic trends, are particularly well-positioned to capitalize on the divergent monetary policies and growth trajectories across developed and emerging markets. As central banks chart different courses, these funds can go long or short various asset classes to capture alpha.

But it’s not just about trading. Many hedge funds are also at the forefront of investing in cutting-edge areas like AI & ML. They’re using these technologies to analyze vast amounts of alternative data, generate investment ideas, and manage risk in real-time.

Rethinking Emerging Markets Equities

For years, investors have treated emerging markets as a monolithic asset class, with allocations driven largely by benchmarks like the MSCI EM Index. But as China’s economy and policies increasingly diverge from other developing nations, that approach is starting to look outdated.

By separating China from the rest of their emerging markets allocation, investors can make targeted decisions about how much and when to invest in the world’s second-largest economy.

This bifurcated approach can provide greater flexibility to manage China-specific risks, while still capturing the growth potential and diversification benefits of other emerging markets. Countries like India, Indonesia, and Brazil stand to benefit as global companies look to reduce their supply chain dependence on China.

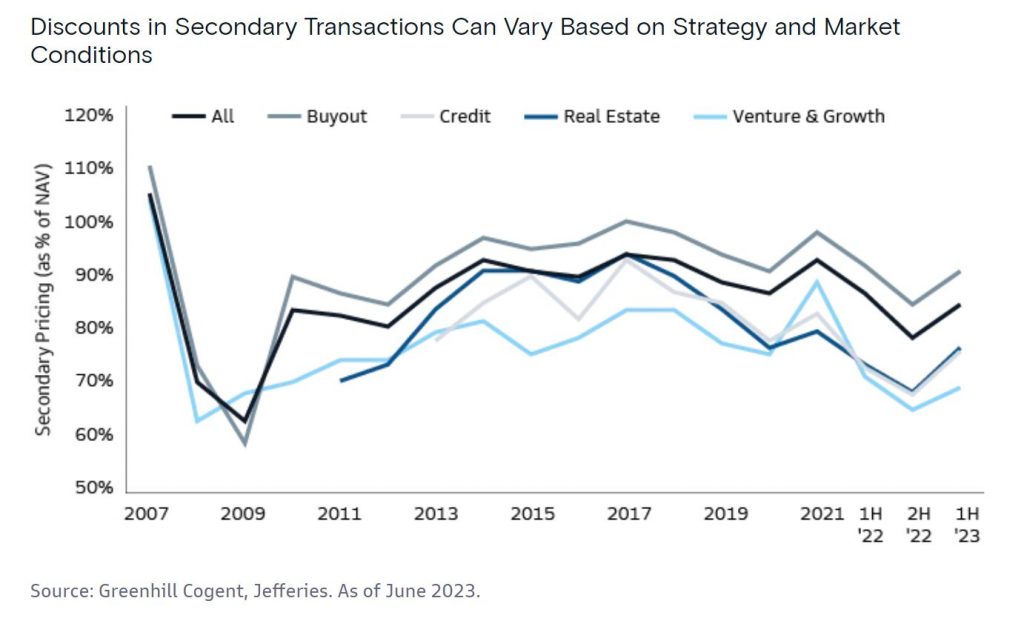

The Expansion of the Secondaries Market

The private equity secondary market, where investors buy and sell pre-existing stakes in private funds, has long been a relatively niche corner of the alternatives world. No longer. With private market assets under management (AuM) topping $10 trillion globally, secondaries are going mainstream as a key source of liquidity for LPs (limited partners) and GPs (general partners) alike.

For LPs, selling fund stakes on the secondary market can provide much-needed liquidity to meet capital calls, adjust risk exposure, or take advantage of attractive pricing. On the flip side, buying secondaries allows LPs to build diversified private market portfolios more quickly and often at a discount to NAV.

GPs are also increasingly turning to the secondary market for liquidity solutions. GP-led transactions can provide liquidity to LPs while allowing GPs to hold onto high-performing assets for longer.

As the secondary market matures, deals are becoming increasingly complex and bespoke. From tender offers and continuation funds to strip sales and preferred equity, the options for tailoring liquidity solutions have never been greater.

Friend-Shoring of Supply Chains

The era of globalization is giving way to a new age of regionalization, as companies and countries alike seek to reduce their reliance on far-flung supply chains. Geopolitical tensions, trade conflicts, and the COVID-19 pandemic have exposed the vulnerabilities of highly concentrated, just-in-time production networks. Now, the watchword is resilience.

Leading the charge are the United States and its allies, who are actively encouraging the “friend-shoring” of critical supply chains. From semiconductors to rare earth metals to pharmaceutical ingredients, the goal is to build redundant sourcing and production capacity in trusted partner countries.

The numbers are staggering. The US CHIPS and Science Act alone provides $52 billion in subsidies for domestic semiconductor manufacturing and research. The Inflation Reduction Act includes hundreds of billions in incentives for electric vehicles, batteries, and renewable energy components — but only if they’re made in North America or by free-trade partners.

For companies, this creates both challenges and opportunities. On one hand, diversifying supply chains and building new capacity closer to home will require significant capital investment.

On the other hand, those same investments will create demand for everything from industrial automation and robotics to cybersecurity and digital infrastructure. And as production moves closer to end markets, companies may be able to capture savings on transport and inventory costs.

For investors, the key is to identify the companies and industries that stand to benefit from this tectonic shift in global trade flows. From construction firms and capital goods manufacturers to defense contractors and critical mineral miners, the opportunities are vast — and still largely untapped.

Conclusion

Asset managers and investors find themselves at a crossroads. The choice is clear. Those who fail to adapt, who fail to innovate, will be left behind. But those who summon the courage to change, who dare to reimagine their strategies and business models, will find themselves at the vanguard of a new era in asset management.

The opportunities are vast, from the democratization of private markets to the rise of personalized indexing, from the mainstreaming of ESG to the transformative power of AI. But seizing them will require more than just lip service to change. It will require a fundamental rethinking of what it means to be an asset manager in the 21st century.