In the high-stakes world of institutional asset management, the difference between success and failure often comes down to a single question…

Who can adapt fastest to the ever-changing market landscape?

Cutting-edge technologies like AI and ML, once the stuff of science fiction, are now being deployed across the investment process, from research and alpha generation to portfolio construction and risk management. By harnessing the power of these tools, institutional investors are uncovering hidden patterns in vast datasets, generating real-time insights, and making more informed, data-driven decisions than ever before.

As the industry rushes to embrace these transformative technologies, institutional investors must approach AI and ML with a clear-eyed understanding of both the opportunities and the risks.

In this article, we will explore the world of AI and ML in institutional asset management, exploring the key applications and unique challenges facing institutional investors as they seek to integrate these technologies into their existing processes.

The future of investing is here – and machines power it.

Summary of Key AI/ML Techniques in Institutional Asset Management

Before we proceed with our exploration, here is a quick refresher on the specific AI-ML techniques most frequently used in the industry.

- LASSO

- Description: Employs an ordinary regression model with a penalty term to ensure the selection of the smallest necessary subset of explanatory variables. This reduces spurious coefficient estimates to zero, enhancing model performance out-of-sample.

- Typical Application: Forecasting.

- Cluster Analysis

- Description: Clusters data into groups with similar characteristics. The number of clusters can be user-defined or algorithm-determined.

- Typical Application: Asset classification.

- Evolutionary (Genetic) Algorithms

- Description: An optimization technique capable of navigating through large, complex, nonlinear solution sets, inspired by natural evolution.

- Typical Application: Advanced portfolio optimization challenges unsolvable by classical methods.

- Artificial Neural Networks

- Description: A nonlinear regression model mimicking brain neurons, capable of learning relationships between input and output data pairs for prediction purposes.

- Typical Application: Forecasting.

- Decision Trees and Random Forests

- Description: Uses a decision tree for unit classification based on features, with random forests averaging several models for more reliable forecasts.

- Typical Application: Classification and forecasting.

- Support Vector Machines

- Description: Suitable for classification or regression, handling nonlinear relationships by mapping inputs to a higher-dimensional space, with faster training times than neural networks.

- Typical Application: Forecasting.

- Natural Language Processing

- Description: Processes natural language data for extracting information from textual media such as social media, websites, and news articles.

- Typical Application: Automatic analysis of corporate annual reports and news articles.

Applications of AI/ML in Institutional Asset Management

Institutional asset managers are always searching for an edge – that elusive piece of information or insight that can help them beat the market. One significant way AI/ML helps achieve this advantage is through alpha generation, which involves creating strategies that provide returns above the market’s baseline performance.

ML algorithms can process vast amounts of structured and unstructured data to mine insights. Traditional data sources, such as financial statements and economic indicators, are now being supplemented with alternative data like satellite imagery, social media sentiment, and web traffic patterns.

Orbital Insight uses computer vision algorithms to analyze satellite images of retail parking lots, using car counts as a proxy for store traffic and revenue growth.

Similarly, firms like Dataminr apply NLP techniques to parse unstructured data sources like news articles and social media posts. By using sentiment analysis, they gauge market sentiment and predict stock price movements.

Quantitative hedge funds like Renaissance Technologies and Two Sigma have been pioneers in the development of predictive models for asset price forecasting. They use complex ML models to sift through massive datasets and identify patterns indicative of future price movements.

Bridgewater Associates, for example, employs ML techniques to simulate a wide range of potential market scenarios and stress-test portfolios under different conditions. This approach allows for a deeper understanding of risk exposures and informs more strategic decisions regarding asset allocation and hedging strategies.

The success of any AI/ML application in asset management research depends heavily on the quality and quantity of data available. Recognizing this, institutional investors are investing heavily in data infrastructure and expertise. They are partnering with specialized firms and hiring data scientists to navigate the complexities of alternative data and ML model development.

Leveraging AI/ML for Operational Efficiency in Institutional Asset Management

AI and ML aren’t just transforming the front office of institutional asset management – they’re also revolutionizing the middle and back office.

ML algorithms can automatically detect and correct errors in data, improving data quality and freeing up human analysts to focus on higher-value tasks. Techniques like fuzzy matching and NLP are being used to reconcile data from different sources and formats, reducing the need for manual intervention.

Sample workflow of fuzzy matching data sharing scheme

For example, BlackRock’s Aladdin platform uses ML to automatically validate and enrich portfolio data, reducing manual errors and improving data consistency across the firm.

Another area where AI/ML is driving operational efficiency is in trade execution. By analyzing historical trading data and market conditions, ML algorithms can optimize trade timing and routing to minimize transaction costs and market impact.

JPMorgan Chase’s LOXM platform is a prime example of this. LOXM uses ML to analyze historical trading data and real-time market conditions, dynamically adjusting its execution strategy to minimize costs and optimize performance.

ML algorithms can also be used to detect and prevent fraudulent activity, such as wash trading and spoofing, by analyzing patterns in trading data and flagging suspicious behavior.

They can also automate the monitoring and reporting of regulatory requirements, reducing the risk of non-compliance, and freeing up compliance teams to focus on higher-value activities.

AQMetrics uses ML to automatically monitor and report on a wide range of regulatory requirements, including MiFID II, AIFMD, and Form PF. The platform can analyze emails and chat logs to detect potential compliance breaches and generate real-time alerts.

AI/ML-Driven Investment Strategies for Institutional Investors

By leveraging the power of data and advanced analytics, institutional investors are finding new ways to generate alpha and manage risk.

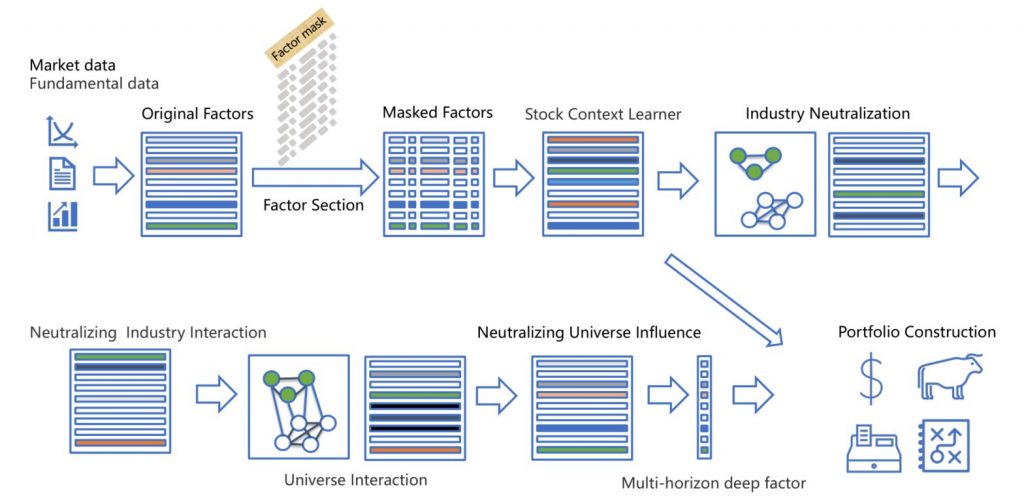

Machine Learning-Based Factor Investing: Traditional factor investing relies on a small set of well-established factors, such as value, momentum, and size, to explain and predict asset returns. However, with the advent of ML, investors can now identify and exploit a much wider range of potential factors.

Deep Learning Framework for Active Investing

Firms are using unsupervised learning techniques like clustering and principal component analysis (PCA) with supervised learning methods like random forests and gradient boosting to build more powerful predictive models.

By leveraging ML to identify novel factors and dynamically adjust factor weights over time, institutional investors can potentially generate more consistent and robust returns than traditional factor-based strategies.

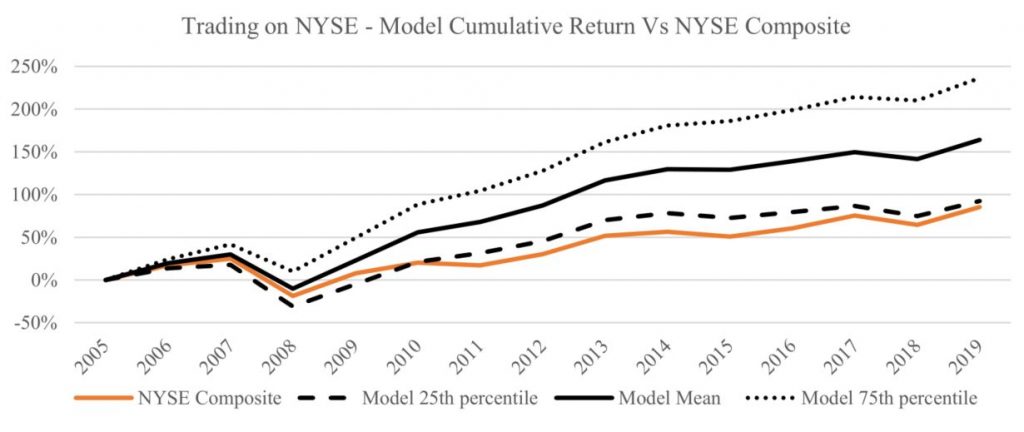

AI-Optimized Portfolio Construction: Traditional portfolio optimization techniques, such as mean-variance optimization rely on simplifying assumptions about asset class returns and correlations that may not hold up in practice.

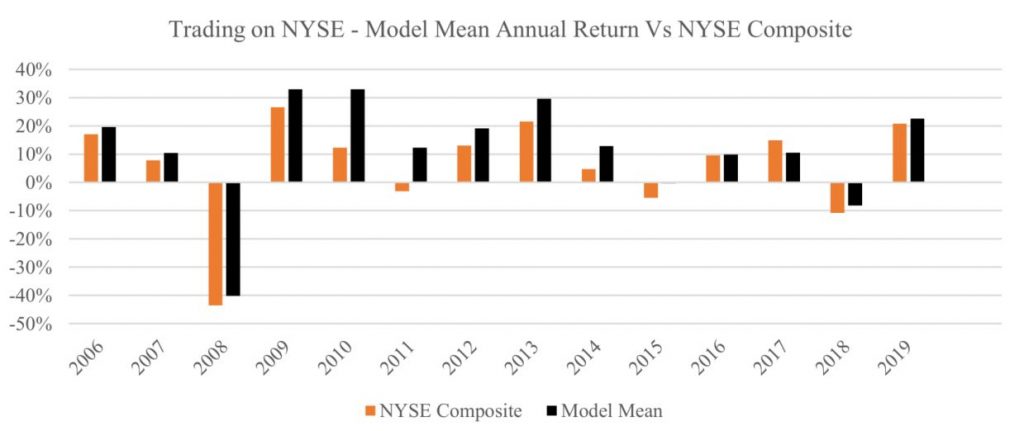

Robustness Test – NYSE – AI Model Vs Index (Cumulative Returns)

AI/ML-based optimization techniques, on the other hand, can account for a much wider range of potential scenarios and dependencies.

Robustness Test – NYSE – AI Model Vs Index (Annual Returns)

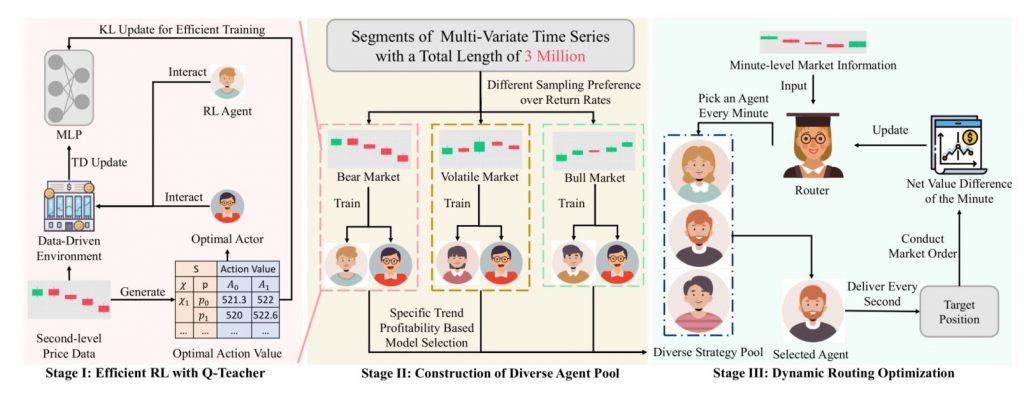

For example, reinforcement learning (RL) algorithms can learn to dynamically adjust portfolio weights based on changing market conditions.

Other ML techniques, such as GANs, can be used to simulate realistic market scenarios and stress-test portfolios under a wide range of potential conditions. By leveraging these advanced optimization techniques, institutional investors can potentially build more resilient and adaptive portfolios.

High-Frequency Trading & Algorithmic Execution: This trading strategy leverages powerful ML algorithms to transact a large number of orders at extremely fast speeds, and it is primarily used by large institutional investors such as investment banks and hedge funds.

The advent of ML is enabling even more sophisticated and adaptive HFT trading strategies. Some firms are using deep learning techniques like convolutional neural networks (CNNs) to analyze raw market data feeds and identify complex patterns that may be predictive of short-term price movements.

Hierarchical reinforcement learning for HFT

Others are using reinforcement learning to train trading agents that can automatically optimize their strategies based on market conditions and adapt to changing environments in real-time.

As more institutional investors embrace these technologies, we can expect to see even more innovative and effective strategies emerge in the years to come.

Unique Challenges and Considerations for Institutional Asset Managers

While AI/ML offers immense potential for institutional asset managers, it also presents unique challenges and considerations that must be carefully navigated.

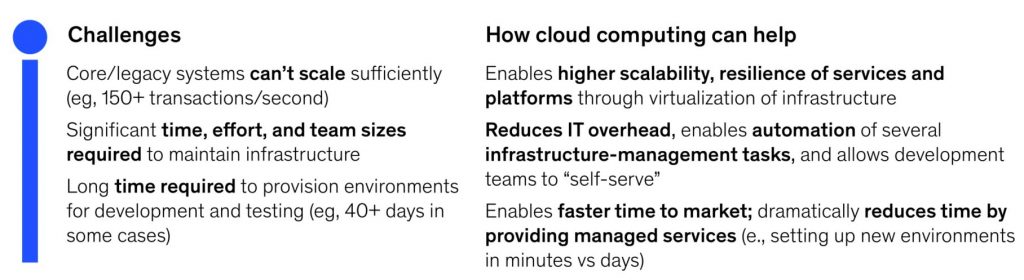

Scalability and Infrastructure Requirements: One major challenge is the scalability and infrastructure required to support large-scale AI/ML deployments.

ML models also require ongoing training and validation, which can be computationally intensive. Firms need robust data pipelines, and distributed computing frameworks like Apache Spark to handle these workloads effectively.

Integration with Legacy Systems: Another challenge is integrating AI/ML models with existing legacy systems and workflows. Many institutional asset managers have complex IT infrastructures with multiple systems for data management, order management, risk analytics, and reporting.

Integrating ML models into these workflows can be difficult, requiring significant data engineering and API development.

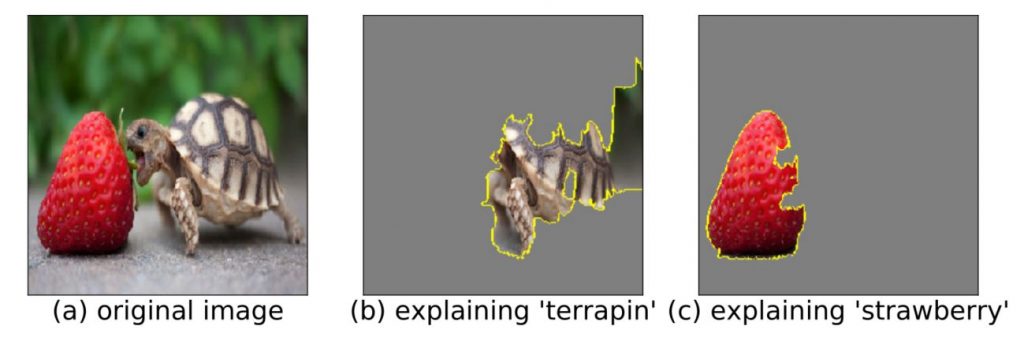

Interpretability and Explainability: Many ML models, particularly deep learning models, are often seen as “black boxes” whose internal workings are difficult to understand and explain.

LIME explanation for object identification in images

This can be problematic for institutional investors who need to justify their investment decisions to clients, regulators, and other stakeholders. Techniques like feature importance analysis, sensitivity analysis, and local interpretable model-agnostic explanations (LIME) can help improve model interpretability.

Talent Acquisition and Retention: Data scientists and ML engineers are in high demand across industries, and financial firms must compete with tech giants and startups for the best talent.

Institutional asset managers need to build strong AI/ML teams with expertise in data engineering, model development, and deployment. They also need to provide ongoing training and development opportunities to keep skills current in a rapidly evolving field.

Governance and Risk Management: Firms need clear policies and procedures around model development, deployment, and monitoring, as well as robust risk management frameworks that can detect and mitigate potential issues.

Best Practices for Institutional AI/ML Adoption

As institutional asset managers increasingly adopt AI/ML, it is crucial to establish robust governance frameworks and adhere to best practices to ensure responsible and effective use of these technologies.

Robust Model Validation and Backtesting: Before deploying any AI/ML model, it must be thoroughly tested on historical data to ensure it performs as expected and does not introduce any unintended risks or biases.

Firms should also establish clear performance metrics and benchmarks for models, such as accuracy, precision, and recall, and monitor these metrics on an ongoing basis to detect any degradation in performance.

Clear Oversight and Accountability: Firms should designate specific individuals or committees responsible for overseeing the development, deployment, and monitoring of models.

This includes setting policies and procedures for model development, such as data quality standards, documentation requirements, and coding best practices.

Vendor Management and Due Diligence: Many institutional asset managers collaborate with external vendors and partners to develop and deploy ML models. In these cases, it is essential to conduct thorough due diligence on vendors and establish clear service level agreements (SLAs) and performance expectations.

Alignment with Investment Objectives: Models should be developed and deployed in service of specific investment goals, such as generating alpha, managing risk, or improving operational efficiency.

This also involves effective communication and collaboration between investment teams, data scientists, and other stakeholders.

Ethical Considerations and Bias Mitigation: Finally, institutional asset managers must carefully consider the ethical implications of AI/ML and take steps to mitigate potential biases or unintended consequences.

Firms should also consider the potential impact of models on diverse groups or individuals and take steps to ensure fairness and non-discrimination.

Future Outlook and Emerging Trends

Several emerging trends and developments in machine learning are poised to shape the future of institutional asset management.

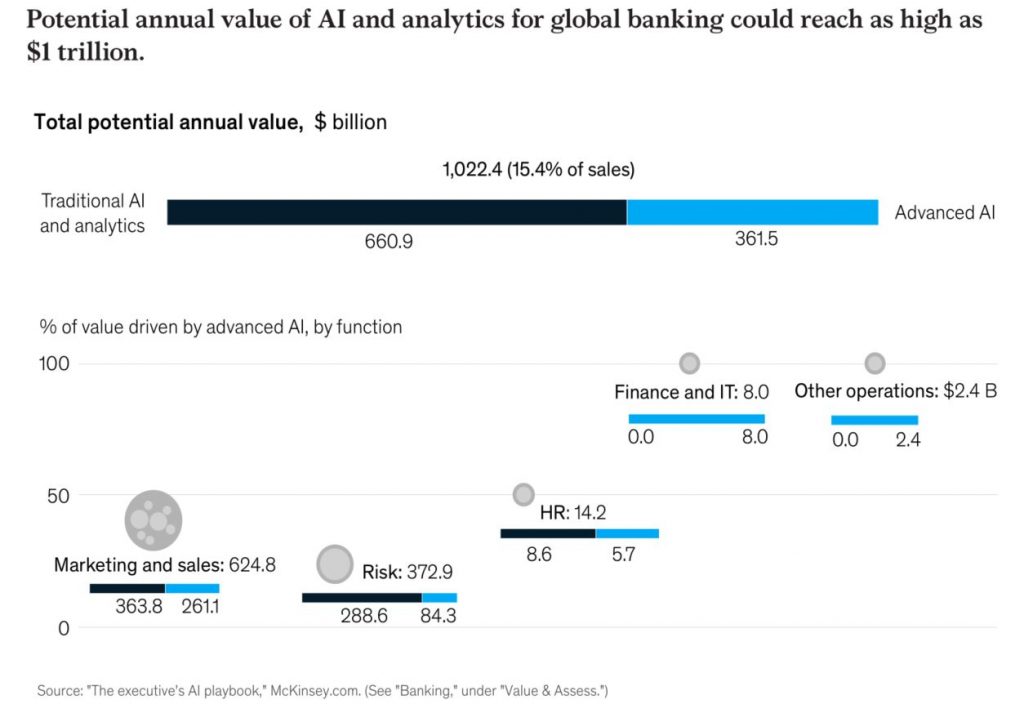

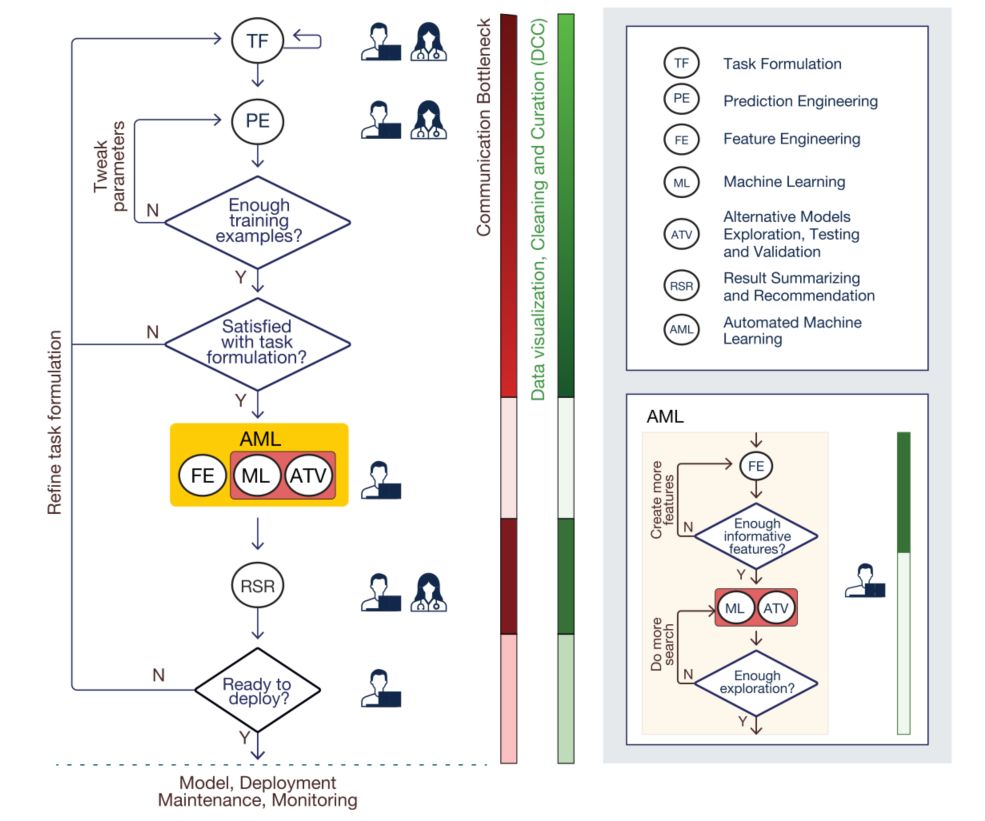

Democratization of AI/ML: We are moving towards the democratization of AI/ML as the tools and technologies become more accessible and user-friendly. Cloud platforms like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are making it easier for firms to access powerful computing resources and pre-built ML models.

A flowchart showing the machine learning process with AutoML

AutoML tools, which automate many of the complex and time-consuming tasks involved in model development, are also gaining traction.

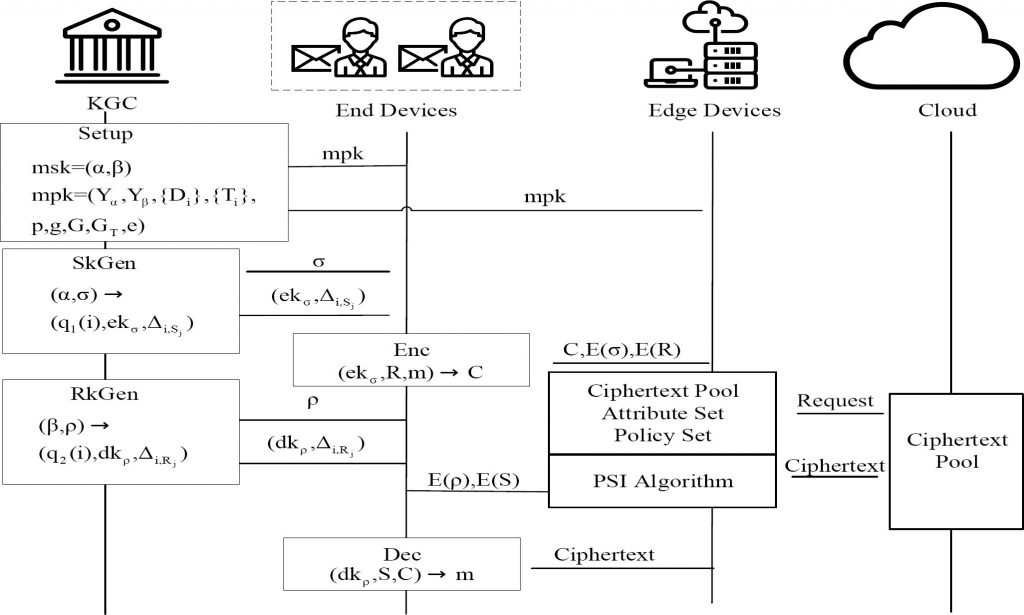

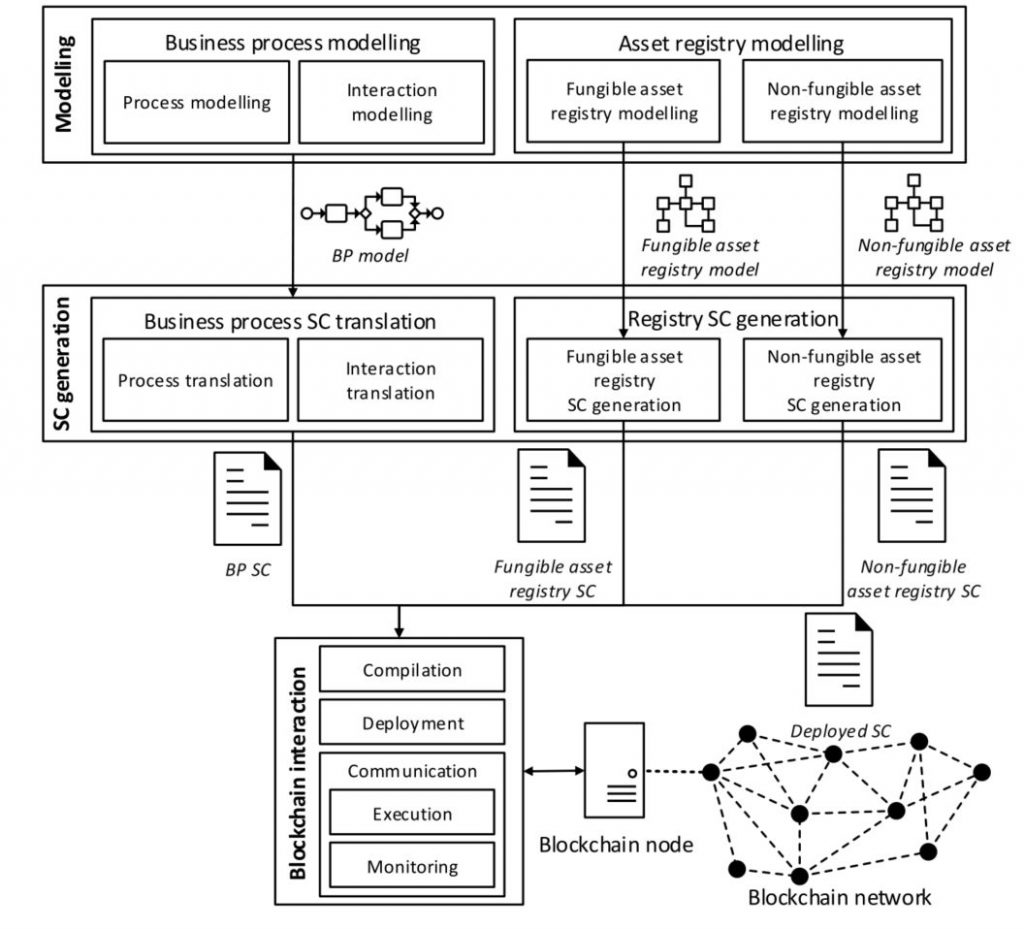

Convergence with Blockchain and Smart Contracts: Blockchain provides a secure and transparent way to record and verify transactions, while smart contracts enable the automated execution of complex financial agreements.

By combining these technologies with AI/ML, asset managers can potentially create new types of investment vehicles and automate many back-office processes.

Sample framework of ML-powered asset management over Blockchain

For example, ML models could be used to automatically rebalance portfolios or execute trades based on pre-defined criteria, with the results recorded on a blockchain for transparency and immutability.

Decentralized finance (DeFi) platforms, which use blockchain and smart contracts to enable peer-to-peer financial transactions without intermediaries, are also an emerging area of interest.

Evolving Role of Humans and Machines: The future of institutional asset management will likely involve an evolving relationship between humans and machines. While AI/ML can automate several tasks and provide valuable insights, human judgment, and expertise will remain essential.

Asset managers will need to develop new skills and roles to effectively collaborate with AI systems – such as data scientists, ML engineers, and quantitative analysts.

Conclusion

From enhancing research capabilities and optimizing investment strategies to improving operational efficiency and risk management, AI/ML is reshaping the institutional asset management industry in profound ways.

- AI/ML enables asset managers to process vast amounts of structured and unstructured data, uncovering new insights and alpha sources.

- Advanced techniques like deep learning, NLP, and computer vision are being used to analyze alternative data and generate predictive models.

- AI/ML is also driving efficiencies in middle- and back-office functions, from trade execution and reconciliation to compliance and reporting.

- Successful adoption of AI/ML requires significant investments in data infrastructure, talent, and governance frameworks.

- Institutional asset managers must navigate unique challenges around scalability, interpretability, and ethics to realize the full potential of AI/ML.

As the pace of technological change accelerates, adopting AI is not just about gaining a competitive edge – it is quickly becoming a strategic imperative. Firms that fail to invest in AI/ML capabilities risk falling behind their peers and losing market share to more agile and innovative competitors.

Asset managers, technology providers, regulators, and academic researchers must work together to address the challenges and opportunities presented by these technologies.

Ultimately, the successful adoption of AI/ML in institutional asset management will require a willingness to experiment, learn, and adapt in the face of rapid change. Organizations that can do so will be well-positioned to thrive in the data-driven future of finance.