Markets heave and dip like the swells of a restless ocean, unpredictable and ever-changing. Amid these swells, pension schemes are adrift, challenged by relentless waves of economic shifts and longer lives.

Each year, the lives of retirees hang more precariously on decisions made not only with numbers but with nerve. In the heart of these tumultuous times, Buy-ins and Buy-outs have become more than strategies—they are promises. Promises that ensure when the time comes, the pensions owed are the pensions paid.

This article delves into the strategic underpinnings of Buy-ins and Buy-outs, illustrating their significance as tools for pension risk transfer in uncertain times.

Why We Need Buy-ins and Buy-outs: Risk

Pension schemes are inherently exposed to a variety of risks that can affect their stability and reliability. Buy-ins and Buy-outs are essential tools designed to manage these risks, securing the financial futures of retirees. Here are some of the main types of risks that these strategies address:

Longevity Risk

Definition: The risk that pension scheme members live longer than expected, leading to a need for payouts that extend beyond the initially projected periods.

Impact: As life expectancy increases, pension funds must pay out benefits for a longer duration, which can strain resources and lead to funding deficits.

Market Risk

Definition: This encompasses the risk associated with fluctuations in market prices, including variations in the values of investments that pension funds hold.

Impact: Significant market downturns can reduce the asset value of pension funds, impacting their ability to meet future obligations. Market volatility makes it difficult to predict fund performance, complicating planning and risk management.

Interest Rate Risk

Definition: The risk that changes in interest rates will affect the value of the bonds and other fixed-income investments in a pension fund’s portfolio.

Impact: Falling interest rates can decrease the income from these investments, reducing the fund’s ability to accrue sufficient assets to pay future pensions. Conversely, rising rates can lead to lower values of current bond holdings.

Investment Risk

Definition: Closely tied to market risk, investment risk involves the chance that the investments made by the pension fund will not perform as expected.

Impact: Poor investment performance can lead to underfunding, requiring either increased contributions or reduced payouts, both of which can have negative repercussions for beneficiaries and sponsoring organizations.

Inflation Risk

Definition: The risk that inflation will erode the purchasing power of future pension payments.

Impact: If the pensions are not adequately indexed to inflation, beneficiaries might find that their benefits buy less over time, reducing the real value of their retirement income.

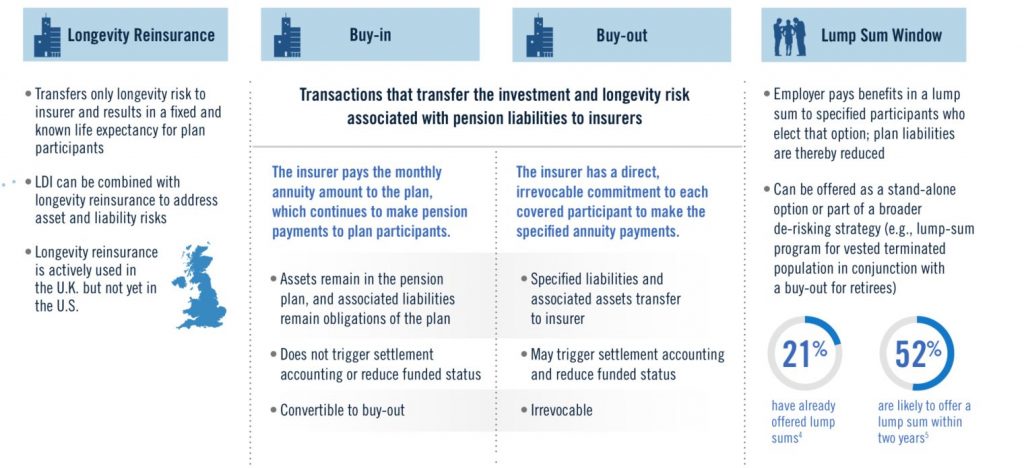

Understanding PRT Buy-ins

A Buy-in transaction is a sophisticated financial arrangement wherein a pension scheme purchases a bulk annuity from an insurance company to cover specific liabilities, often those of already retired members.

The essence of a Buy-in lies in its ability to mirror the payouts due to pensioners. The insurance company assumes the responsibility for making these payments directly to the scheme, which then passes them on to the retirees. This transaction is reflected on the pension scheme’s balance sheet, distinguishing it from a Buy-out where liabilities are transferred off the balance sheet.

Mechanics and Contractual Setup: In a Buy-in, the pension scheme and the insurer agree on a premium that reflects the present value of future pension payments, adjusted for the expected longevity of beneficiaries, and anticipated future interest rates. The contractual terms often include provisions for adjusting payments based on actual member longevity and inflation, ensuring that payments remain aligned with the scheme’s liabilities.

Scenarios for Opting for Buy-ins: Buy-ins are particularly appealing in scenarios where trustees want to reduce risks associated with their liabilities but prefer to keep the pension obligations on their books.

Situations that might prompt a Buy-in include reaching a funding target that allows for risk reduction without a full scheme wind-up or capitalizing on favorable insurance pricing to lock in costs before potential market downturns.

Advantages

- Risk Reduction: Buy-ins significantly decrease longevity and investment risks by transferring them to the insurer.

- Stabilization of Funding Levels: They help stabilize the funding status of pension schemes against financial market volatility.

- Flexibility: They provide a stepping stone towards a full Buy-out, without immediately committing to transferring all liabilities.

Disadvantages

- Cost: The upfront cost can be substantial, and the pricing of Buy-ins is sensitive to market conditions such as interest rates and insurer risk appetite.

- Complexity: Negotiating and managing Buy-in contracts require specialized expertise and can be resource-intensive.

- Incompleteness: While they mitigate certain risks, other administrative responsibilities and some risks such as inflation adjustments (unless specifically covered) remain with the scheme.

Understanding PRT Buy-outs

A Buy-out in pension risk management involves a pension scheme transferring its liabilities entirely to an insurance company. This transaction ensures that the insurer assumes full responsibility for paying all future pension benefits directly to the retirees. Unlike a Buy-in, after a Buy-out, the pension liabilities are entirely removed from the scheme’s balance sheet, effectively ending the scheme’s obligations to its beneficiaries.

Selected pension buyout transactions with PICA in the United States, November 2012–January 2019

Mechanics and Contractual Setup: In a Buy-out, the pension scheme pays a premium to the insurer, calculated based on the present value of future pension payments. This premium accounts for various factors, including the projected lifespans of the members and expected future economic conditions. The contractual terms are crucial and typically ensure that all obligations are fully covered, transferring all associated risks to the insurer.

Scenarios for Opting for Buy-outs: Buy-outs are often pursued when a pension scheme is fully funded and the trustees or sponsoring company wishes to completely remove pension-related volatility from their financials. Other triggers include corporate restructuring, such as during mergers or acquisitions, or when a company decides to offload legacy liabilities to focus on its core business operations.

Typical roles in the buy-out process

Advantages

- Risk Elimination: Buy-outs transfer all financial risks related to pension payments to the insurance company, providing total risk offloading.

- Simplification: They simplify the company’s balance sheet and remove the administrative burden of managing a pension scheme.

- Certainty: Beneficiaries receive a guaranteed payment from a financially secure insurer, providing peace of mind for both the company and its retirees.

Disadvantages:

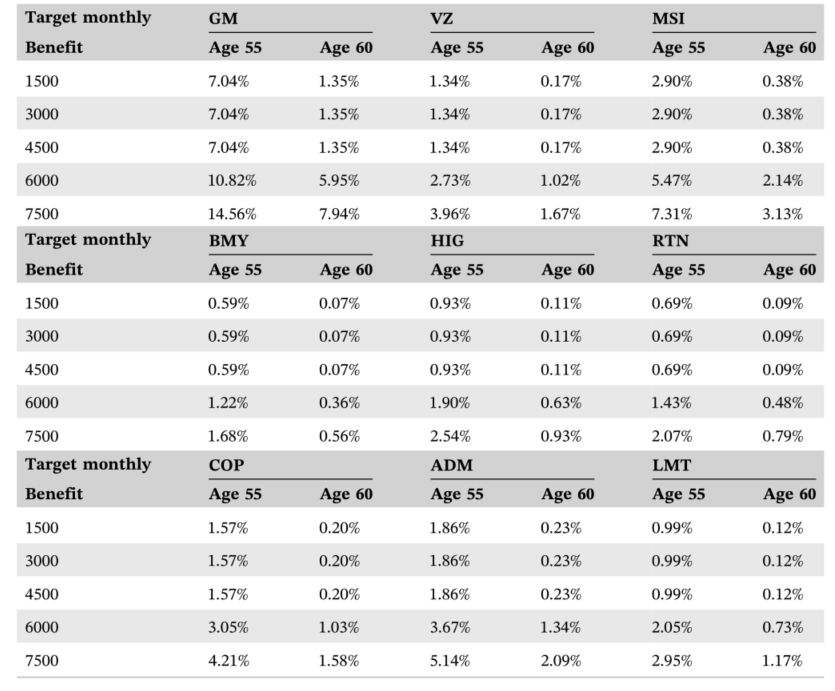

Percentage expected default losses of participants who remained in the plans after the buyouts

- High Cost: The upfront cost of a Buy-out is typically higher than a Buy-in, reflecting the total transfer of liability.

- Inflexibility: Once completed, a Buy-out is irreversible, limiting future options for the pension scheme and its sponsors.

- Dependency on Insurer Stability: While it transfers risk, the security of pension payments relies entirely on the financial health of the chosen insurance company.

Comparing Buy-ins and Buy-outs: A Detailed Analysis

Understanding the nuances between Buy-ins and Buy-outs is critical for pension scheme trustees and sponsors to make informed decisions. While both strategies aim to manage pension risks, their structural differences, financial implications, and effects on members vary significantly.

Differences in Structure and Impact

Buy-ins and Buy-outs differ fundamentally in how they are structured and their subsequent impact on pension schemes.

A Buy-in is a transaction where the pension scheme buys an insurance policy that covers the liabilities for certain members, typically retirees. The scheme retains the responsibility of paying the pensions, using the payments received from the insurer.

In contrast, a Buy-out involves the pension scheme transferring all its liabilities related to a group of members or all members to the insurer. This removes the liabilities from the scheme’s balance sheet, effectively ending the pension scheme for those members.

The contractual implications are profound. In a Buy-in, the contract is typically between the pension scheme and the insurer, with the scheme continuing to manage member benefits. In a Buy-out, the contract transfers member benefits directly to the insurer, who then becomes responsible for all future payments to the beneficiaries.

Financial Implications

The financial implications of Buy-ins and Buy-outs can be viewed through the lens of cost and benefits. Buy-ins are generally less expensive upfront because they cover only a portion of the scheme’s liabilities and do not completely remove the liabilities from the scheme’s books.

This can be advantageous in maintaining some investment flexibility and potential growth in assets. However, the cost of converting a Buy-in into a Buy-out in the future could lead to higher overall expenses if the insurance market conditions change unfavorably.

Buy-outs, while more costly at the outset due to the complete transfer of liabilities, provide absolute cost certainty and remove any future financial risk related to the covered members from the sponsor. This can be particularly appealing for schemes looking to de-risk entirely or for companies wanting to clean up their balance sheets for strategic reasons.

Effects on Pension Scheme Members

From the perspective of scheme members, Buy-ins and Buy-outs also differ in their impact. With a Buy-in, members may not notice any immediate change, as they continue to receive payments from the pension scheme itself. The scheme manages the relationship with the insurer and maintains control over the assets not covered by the Buy-in.

In a Buy-out, members become direct beneficiaries of the insurer. This change can lead to differences in the administration of benefits and may potentially alter the experience for the retirees, depending on the insurer’s service quality. However, the certainty of receiving benefits is typically enhanced under a Buy-out, as the financial responsibility shifts entirely to the insurer, backed by regulatory solvency requirements.

By analyzing these aspects, trustees and sponsors can better appreciate how Buy-ins and Buy-outs fit into their broader pension risk management strategies, each offering distinct advantages and considerations depending on the scheme’s financial health, risk appetite, and long-term objectives.

Case Studies: Buy-ins and Buy-outs in Action

Real-world examples of Buy-ins and Buy-outs provide valuable insights into how these strategies are implemented in practice, their successes, challenges, and the lessons learned. By examining both recent and historical cases, we can derive best practices and understand the critical factors that influence the outcomes of these pension risk transfer strategies.

The Telent Pension Plan Buy-out

In 2019, the UK-based telecommunications company Telent (formerly Marconi) completed a full Buy-out of its pension plan with Rothesay Life. This was one of the largest deals of its kind at the time, covering liabilities of approximately £4.7 billion. The Buy-out was sought as part of a broader corporate strategy following significant restructuring and divestments.

Successes:

- The buy-out provided absolute certainty for the scheme’s members, with no further premiums due, ensuring their benefits were fully secured.

- The transaction was a result of over a decade of strategic asset de-risking and liability-driven investment (LDI) by the trustees, which positioned the scheme favorably for such a large-scale buy-out.

- The premium was locked to the scheme’s existing assets upfront. It provided cover for residual risks from the point of signing, which was particularly advantageous during a period of volatile global markets.

Challenges:

- The scale of the transaction was unprecedented. It required meticulous preparation and due diligence by the trustees, which included extensive work on historical documentation and administration.

- Managing the transition to insurance and the full wind-up of the scheme required close collaboration with the scheme’s administration team to ensure a smooth process for all stakeholders.

London Stock Exchange Buy-in

In May 2023, the London Stock Exchange Group Pension Scheme completed a £335 million bulk purchase annuity deal with Standard Life, covering 1,740 members across both the LSE and London Clearing House sections. Aon led the advisory team for this transaction, with legal guidance provided by Eversheds Sutherland and investment advice by Redington.

Successes:

- The buy-in was a significant step in the group’s long-term pension strategy, aimed at providing greater certainty and reducing risks associated with the pension scheme.

- The collaborative efforts of the trustee, London Stock Exchange Group, their advisers, and Standard Life were instrumental in the successful execution of the deal.

Challenges:

- The transaction required a comprehensive understanding of the scheme’s specific de-risking needs and the creation of a tailored solution to meet these requirements.

- Communicating the changes and ensuring a consistent member experience across different policies was a critical aspect of the process, especially when moving towards a full buy-out.

Conclusion

Through this article, we have explored the landscape where buy-ins and buy-outs operate, detailing their structures, impacts, and the nuanced differences that dictate their application. Buy-ins provide a partial risk transfer, maintaining the pension scheme’s ongoing involvement and gradual stabilization. Buy-outs, in contrast, offer a complete transfer of liabilities, granting absolute certainty at a higher initial cost.

The strategic importance of these tools cannot be overstated. As the economic landscape evolves and demographic shifts continue, the need for robust risk management strategies becomes increasingly critical.

We encourage trustees, sponsors, and corporate managers to delve deeper into the intricacies of these options. Further research and consultation with professionals in the field will provide the bespoke insights necessary to navigate this complex area.